Loan Transactions, Made Simple

FOR FINANCIAL ADVISORS

CapitalHub | Client Lending Solution

Access, Guidance & Advocacy

Osaic CapitalHub offers tailored lending solutions designed to support your clients at every stage of growth. From an entrepreneur seeking capital for a new venture, a real estate developer financing a project, or a business owner looking to expand operations, we have partnered with Community Capital to provide range of credit options to enable clients to achieve their professional and personal financial goals.

With direct, on-demand access to an extensive network of banking and lending institutions, our Captal Solutions team provides personalized guidance at every stage of the lending process. From identifying your client’s needs to presenting customized options and then supporting them through every step to loan closing, our aim is to ensure a smooth, results-driven experience.

For more information about how Osaic CapitalHub can assist your clients or to discuss a specific opportunity, please fill out the form or contact our team directly.

Lending Solutions for Every Client Need

Whether your client is purchasing a home, refinancing, expanding their business, or financing a specialty asset, our partners at Community Capital will connects them with tailored lending solutions across a broad range of loan types. Explore options and submit a detailed loan inquiry to get started.

Residential Mortgages

Whether your client is purchasing a primary residence, refinancing an existing home, or acquiring a vacation property, our residential mortgage solutions provide competitive options with concierge-level support. On the next page, you or your client can submit a detailed loan inquiry to begin exploring mortgage options tailored to their needs.

Commercial & Specialty Loans

From business expansion and investment real estate to unique assets like aircraft or marine financing, our Commercial & Specialty loan solutions are designed to support a wide range of complex financing needs. You or your client can submit a detailed inquiry on the next page to get matched with the right lending solution.

To speak with the Osaic's Capital Solutions Team directly, please contact:

Lorena Olivas

Lorena Olivas

Osaic Capital Solutions

E: capitalsolutions@osaic.com

T: (866) 495-0958

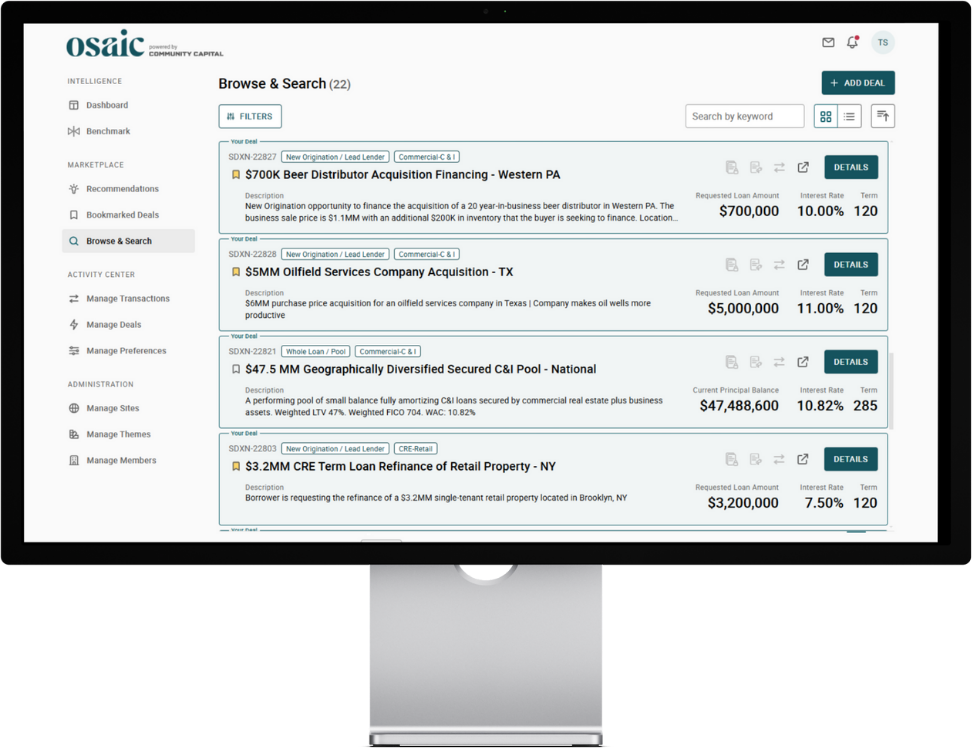

Access a Nationwide Network of Financial Institutions & Other Originators

Current PNC Bank Members include:

Exploring Lending Solutions with Clients | Overview

Learn more about the CapitalHub client lending service, the various loan options available, and essential questions to ask during your client discussions.

Discover how our team supports you and your clients at every juncture of the process - from initiating the conversation to guiding clients through to loan closing.

Value Add for

Osaic Advisors & Clients

Solution Highlights

-

EXCEPTIONAL ACCESS

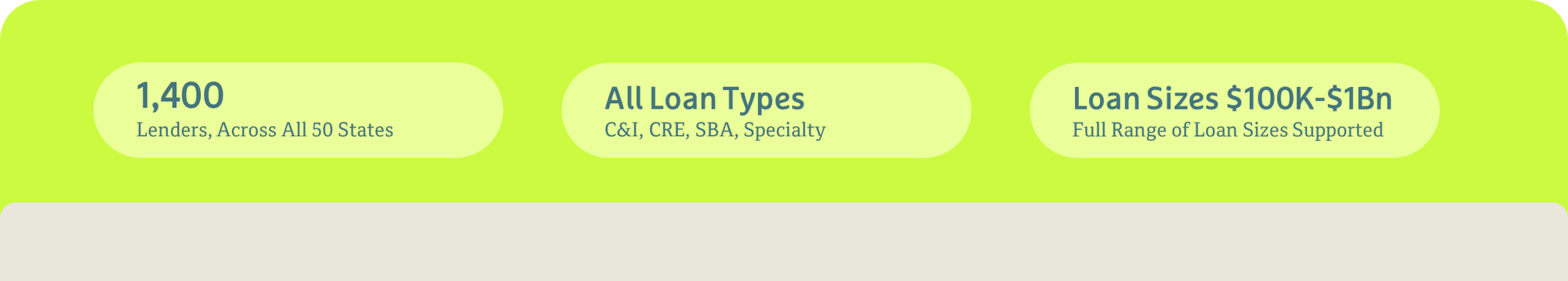

Nationwide network of over 1,400 institutions available on-demand to review each client opportunity

-

DIVERSE OPTIONS

Lending solutions across multiple asset class and loan types ensures that almost any client credit need can be supported

-

ANONYMOUS

All requests are posted anonymously - clients can post an inquiry and review proposals prior to sharing information

-

EXPERIENCED GUIDANCE

Each opportunity is reviewed and optimized by a dedicated team of credit specialists prior to posting on the marketplace

-

DEDICATED SUPPORT

The Osaic & CCT teams work with you and the client at every step to facilitate communications with lenders

-

DEEPER CLIENT INSIGHTS

Providing credit solutions gives wealth managers an even deeper understanding of their client's financial needs, goals

Recent Case Study | Interstate Bank (TX)

" Finding loans to buy is frustrating for a bank our size. In the past, we have had to turn to five different sources to access five different types of loans. So having just one place to turn to that we can trust to help us with the entire process is a game changer..."

Creative Planning | Client Credit Opportunity Case Study

Frequently Asked Questions.

Security

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nullam tempor arcu non commodo elementum.

Deal Flow

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nullam tempor arcu non commodo elementum.

Lending Insights | Client Stories & Education

EDUCATION

More About Lending

-

| EDUCATION |

C&I LendingLearn more about Commercial & Industrial Loans and

how they can support client business growth. -

| EDUCATION |

CRE LendingLearn more about CRE loans and how they can

support clients' real estate needs.

-

| EDUCATION |

SBA 7a LendingLearn more about SBA 7a loans and how

they can support small business financing.

-

| EDUCATION |

| EDUCATION |

SBA 504 LendingLearn more about SBA 504 loans and howthey can support small business financing.

CASE STUDIES

Client Stories & Solutions

Commercial & Industrial ("C&I")

-

| CASE STUDY |

Acquisition Financing • Car WashEfficiently sourced financing for an entrepreneurial

client looking to fund a business acquisition. -

| CASE STUDY |

Franchise Finance • Father/Son PartnershipNew family entrepreneurial venture finds

attractive financing for franchise acquisitions.

-

| CASE STUDY |

Acquisition Financing • Oil & Gas ServicesPartners seek financing options to

support purchase of operating company.

-

| CASE STUDY |

CapEx & Debt Consolidation • FranchiseSecond-generation franchise owner sources loan

to finance capital expenditures

-

| CASE STUDY |

Franchise Finance • New TerritoryHusband & Wife team looking to acquire

new franchises to expand territory

Client Stories & Solutions

Commercial Real Estate ("CRE")

Case Studies | Client Lending Stories

"Lorem ipsum dolor sit amet, consectetur adipiscing elit. Duis accumsan velit sit amet sagittis malesuada."

Commercial Lending

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

-

Line of Credit

Enabled client to find an acquisition line of credit for their real estate investment portfolio.

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

Residential Mortgages

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

-

Line of Credit

Enabled client to find an acquisition line of credit for their real estate investment portfolio.

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

Specialty Lending (SBLOC, Aviation, Marine)

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

-

Line of Credit

Enabled client to find an acquisition line of credit for their real estate investment portfolio.

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

Commercial Lending

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

-

Line of Credit

Enabled client to find an acquisition line of credit for their real estate investment portfolio.

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

Residential Mortgages

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

-

Line of Credit

Enabled client to find an acquisition line of credit for their real estate investment portfolio.

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

Specialty | SBLOC, Aviation, Marine

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.

-

Line of Credit

Enabled client to find an acquisition line of credit for their real estate investment portfolio.

-

Acquisition Financing

Efficiently sourced financing for an entrepreneurial client looking to fund a business acquisition.