Explore Residential Lending Solutions

Competitive options, powered by Community Capital and NBKC Bank

Osaic CapitalHub, powered by Community Capital, makes it easy to explore either residential mortgages or home equity line of credit (HELOC) options and secure financing tailored to your goals. Residential mortgage loans can help you purchase or refinance a primary residence, second home, or investment property, while HELOCs provide a convenient way to access the equity in your current home to fund major expenses or new opportunities. Community Capital is Osaic’s dedicated lending marketplace partner, providing our clients with direct, efficient access to competitive financing solutions.

Submit a Loan Inquiry

Simple, Fast Home Financing Options

Osaic clients can now access streamlined home financing solutions - whether purchasing or refinancing a property or tapping into home equity - through our partnership with Community Capital and NBKC Bank, a top-rated lender known for speed, transparency, and competitive pricing. Through this exclusive offering, you gain access to preferred rates and a dedicated lending team that ensures a smooth, guided experience every step of the way from application to close.

Select the option below that fits your needs to begin your loan application through NBKC’s secure loan portal.

-

Apply for a Residential Mortgage Loan. Purchase or refinance a primary residence, second home, or investment property.

-

Apply for a Home Equity Line of Credit (HELOC). Access equity in your existing home to fund expenses or opportunities.

Once your initial request submitted, you will receive a direct response from NBKC within 24 hours, including a review of your submission and personalized loan options designed to meet your specific financing needs.

Start an Application for a HELOC or Residential Mortgage

HOME EQUITY LINE OF CREDIT (HELOC)

Access the Value in Your Home

Unlock your home’s equity with a flexible line of credit that provides convenient access to funds for major expenses, renovations, or new opportunities.

RESIDENTIAL MORTGAGE

Finance or Refinance Your Home

Secure competitive financing to purchase a new home or refinance your existing mortgage - designed to deliver a fast, transparent, and seamless experience.

3 Simple Steps to Apply

Receive a quote as quickly as 1 day

1. Click Applicable Loan Application Button (above)

2. Complete Easy Application (5 minutes!)

3. Receive a Quote* within about a day

*Once your HELOC or Residential Mortgage application is submitted, your information will be reviewed and you will be contacted directly by an NBKC Loan Officer to review your offer and options.

See What’s Possible

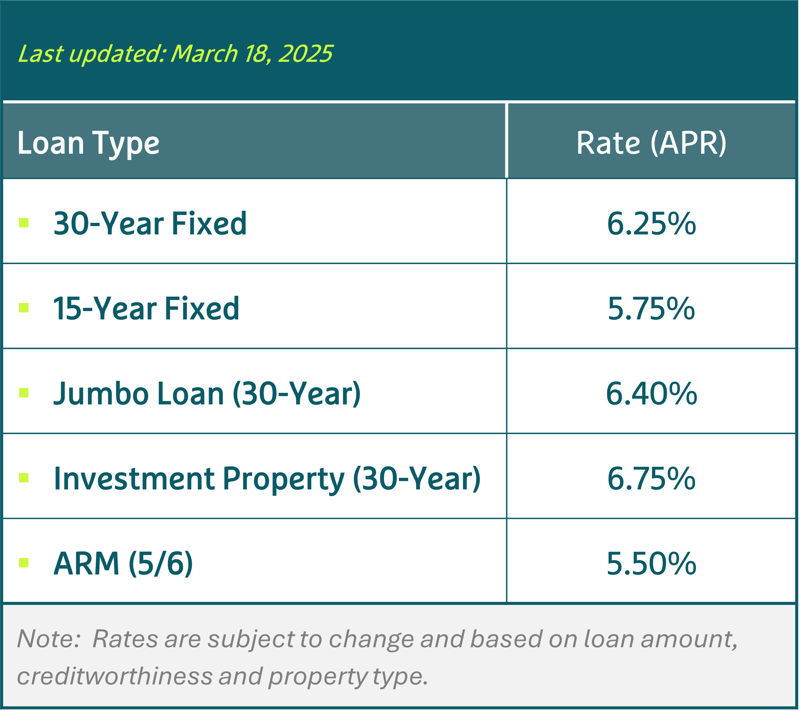

Explore a snapshot of current estimated rates for a range of standard residential mortgage products, including conventional, VA, FHA, and ARM options.

These rates are updated regularly to reflect market conditions, but rates may vary based on individual applicant's situation.

To view personalized rates or begin the process, please complete the residential mortgage application linked above.

Please Note: Rates shown are estimates only and based on select assumptions, including high credit scores and typical loan structures. Your actual rate may vary depending on credit profile, loan amount, property type, and other factors.

Looking for a Commercial or Specialty Loan?

Not only do we offer solutions for residential loans, CapitalHub also delivers access to business loans, commercial real estate (CRE) financing, SBA loans, equipment loans, and other specialty lending options (planes, boats). We make it easy - with a clear process, personalized support, and expert guidance shaped around your business or personal financing goals.

3 Simple Steps to Apply

Receive a quote as quickly as 1 day

1. Click Loan Application Button (above)

2. Complete Easy Application (5 minutes!)

3. Receive a Quote* within about a day

*Once your application is submitted, your information will be reviewed and you will be contacted directly by an NBKC Mortgage Loan Officer to review your offer.

Need Assistance?

If you have any questions before you get started, please contact our Team directly.

Lorena Olivas

Lorena Olivas

Manager

Osaic Capital Solutions

Contact Us:

Tel: +1 (866) 495-0958

Email: capitalsolutions@osaic.com